Highlights:

- Endowment valued at $30.7 billion as of June 30, down $1.3 billion (4.1 percent) from $32 billion a year earlier.

- Harvard Management Company records -0.05 percent investment return on endowment assets during fiscal year 2012.

- Fixed-income assets lead positive returns, but equities produce negative returns.

- Harvard’s performance narrowly exceeds its market benchmarks, but trails returns reported by some other institutions.

- Investment managers remain cautious about the investment outlook.

Harvard’s endowment was valued at $30.7 billion as of June 30, the end of fiscal year 2012—down 4.1 percent from $32 billion at the end of fiscal 2011—according to the annual report released today by Harvard Management Company (HMC). During the fiscal year just ended, HMC recorded an investment return (after expenses) of -0.05 percent on endowment and related assets. This followed the positive 21.4 percent investment return earned in fiscal 2011 and the 11.0 percent return in the prior year—a period of strong recovery in the investment markets following the financial upheavals and severe recession in 2008-2009.

The absolute decline in the value of the endowment reflects the return earned on invested assets (essentially nil); minus the distribution of endowment funds to support University operations and for other purposes (perhaps $1.5 billion in fiscal 2012); plus endowment gifts received during the year. (Exact sums for investment returns, endowment distributions, and gifts will be disclosed in the University’s annual financial report, to be published in mid to late October.)

Seen in this light, the value of the endowment is of fundamental importance for Harvard’s finances. Endowment distributions account for roughly one-third of University revenue (nearly 38 percent in fiscal 2011, according to that year's annual financial report). To maintain purchasing power, HMC’s investment professionals aim for a long-term annualized rate of return of approximately 8 percent, so the endowment appreciates even after a normalized 4.5 percent to 5 percent distribution rate. Although the endowment has now recovered somewhat from its post-crisis low of $26.o billion at the end of fiscal 2009, it remains significantly below the record $36.9 billion reported at the end of fiscal 2008—and must support a larger physical plant, much-expanded financial aid, and other costs. Those are the considerations weighing on the Corporation as it sets future distributions (at a time when the level of future federal support for research is uncertain, and families’ abilities to pay higher tuition bills remain under severe pressure)—and as the administration continues planning for a large fundraising campaign, likely to be unveiled next autumn.

As previously reported, investment returns were expected to decline this year—given economic and financial-market weakness in the United States, throughout Europe, and now in important developing economies like China and India. HMC’s essentially flat results compare with these reported to date by other institutions:

- The perennially strong University of Virginia Investment Management Company, which reported a 5.1 percent return for fiscal 2012, versus its 24.3 percent return in the prior year.

- MIT’s 8.0 percent investment return for fiscal 2012, compared with 17.9 percent in fiscal 2011.

- Princeton’s preliminary release of a fiscal 2012 return of 0 to 5 percent, as reported by Bloomberg, versus 22 percent in fiscal 2011.

- The University of Pennsylvania’s reported fiscal 2012 return of 1.6 percent, down from 18.6 percent in the prior year.

- Amherst’s reported return of approximately 1 percent in fiscal 2012.

- Updated September 28: Subsequent reports by peer institutions both showed positive returns: Yale, 4.7 percent, and Stanford, 1.0 percent.

Performance Details

HMC’s reported rate of return on investments exceeded the -1.03 percent return calculated using market benchmarks for the assets in the “policy portfolio.” (That is HMC’s model for allocating assets among categories such as equities, fixed-income instruments, real estate, and so on; details—including the new fiscal 2013 allocations, discussed below—are posted here.) This is the third year in a row of relative outperformance for HMC's investments, compared to the benchmarks for assets in the policy portfolio (following underperformance in fiscal 2009).

On the other hand, highly diversified endowments like Harvard’s, with their significant commitment to illiquid investments (private equity, hedge funds, natural resources, real estate) have continued to lag behind traditional 60 percent stock/40 percent bond portfolios. According to HMC’s figures, Harvard’s fiscal 2012 flat return trailed the 6.71 percent return of the traditional, undiversified portfolio; for the past three-year period, Harvard’s annualized rate of return was 10.42 percent, versus the 12.82 percent traditional portfolio’s return.

Fiscal 2012 was a highly volatile year for investors—a point forecast by HMC president and CEO Jane L. Mendillo in the fall of 2011. As summarized in her report on the year now ended:

The first five months of the year were characterized by a sharp downward correction in the public equity markets, driven by the U.S. debt-ceiling debate, stress in the euro zone, and fears of a slowdown in the Chinese economy. Although not as disorderly, there were some moments involving negative returns and high correlations among asset classes that were reminiscent of the summer-fall of 2008.

By early fall 2011 the impact was significant—the S&P [500 equity index] was down nearly 20 percent, European stocks were down 30 percent, and natural gas was down 25 percent. As fall changed to winter the world equity markets shook off their anxiety and recovered nicely, however market sentiment turned sharply negative once again in the spring.

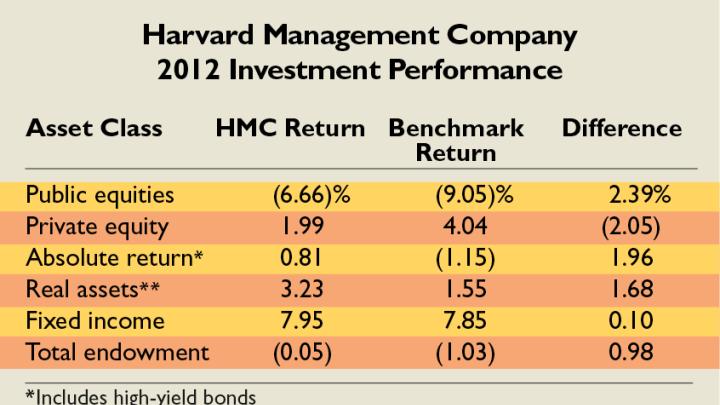

Not surprisingly, performance varied widely among kinds of investments (see figure above, displaying performance for fiscal 2012 by asset class, compared to each external benchmark; figures for fiscal 2011 appear below).

Public equities. The divergent results were particularly pronounced in public stock investments—about one-third of HMC’s endowment assets, roughly equally divided among three classes: domestic; developed foreign markets; and emerging foreign markets.

Domestic equity returns were 9.65 percent—5.57 percentage points better than the market benchmark HMC uses for this class of assets. But developed-market foreign and emerging-market equities yielded returns of -10.81 percent and -17.43 percent—respectively, 3.16 percentage points better and 1.48 percentage points worse than market benchmarks.

As a whole, public equity returns were -6.66 percent, or 2.39 percentage points better than the market benchmark.

Private equity. Private-equity and venture-capital investments (roughly 13 percent of the portfolio) yielded a 1.99 percent return, trailing their benchmark by more than 2 percentage points. In recent years, HMC has been more cautious about private-equity investments, reflecting both increased competition for such assets (and therefore declining returns) and the illiquidity they entail. Now, however, there are indications that the investment managers see some emerging opportunities, and are aiming to increase the policy-portfolio weighting by a couple of percentage points over the next several years.

Absolute return. Absolute-return assets (a category in which HMC includes both hedge funds and a smaller portfolio of high-yield fixed-income investments, together accounting for about one-sixth of endowment investments) produced a nominally positive return (0.81 percent), nearly 2 percentage points better than the negative returns for the market benchmarks in this segment.

Real assets. HMC continues to emphasize investments in real estate, natural resources (owned assets such as timberland and farmland), and publicly traded commodities such as oil, natural gas, agricultural commodities, minerals, and so on—nearly one-quarter of the total policy portfolio. An early proponent of natural-resources investments, Mendillo emphasized their appeal in a recent Bloomberg interview. The theory, discussed in the HMC report, is that such assets produce goods that are in increasing demand for which it is difficult to increase supply quickly, and that successful natural-resources investing requires staff expertise of the sort the management company has built.

Within the real assets category as a whole (where returns of 3.23 percent more than doubled benchmark results), real-estate investments were the strongest performer, returning nearly 8 percent and exceeding market returns. Natural resources returns were positive, at 2.40 percent, ahead of the benchmark. Publicly traded commodities lagged at -8.14 percent, but were better than the even-larger market losses.

Mendillo’s comments suggest further increasing HMC’s policy-portfolio exposure to natural resources in coming years, perhaps by a few more percentage points. That increased allocation, and the possible private-equity commitments, would be accommodated by reduced emphasis on absolute-return and fixed-income investments.

Fixed income. The bond portfolio—about 10 percent of investments—in aggregate provided HMC’s strongest absolute return (7.95 percent), narrowly better than the market benchmark. Domestic, foreign, and inflation-indexed bonds apparently all contributed to the relatively good performance.

A “Stabilized” HMC

Compared to prior years’ reports, in which Mendillo described significant changes in HMC’s staffing, risk management, and devotion to increased liquidity, the fiscal 2012 report suggests that most such transition issues are in the past. “Our company and our portfolio have stabilized and strengthened from their post-financial-crisis state,” she wrote. “Regarding the HMC organization, with a few near-term planned additions to our internal equities team, we anticipate being fully staffed on both the investment and support sides for the first time in several years.”

HMC remains a hybrid organization, with perhaps two-thirds of assets managed externally and one-third in-house, but it continues to shift more funds to internal management as opportunities and staff skills warrant.

She further noted, “We have made good progress on rebalancing the mix of liquid and illiquid assets in our portfolio, although we are not quite where we want to be yet.” Obligations to provide future funding to outside managers—so-called capital commitments—apparently continue to decline, from the peak level of $11 billion at the end of fiscal 2008 and about $5 billion in fiscal 2012 to a somewhat lower level now, creating more flexibility. Despite the volatile financial markets, Mendillo wrote, “[W]ith our improved liquidity we have been active investors throughout the year in both liquid and illiquid markets.” As a result, “We were…encouraged by the breadth of new investment opportunities we found through both internal and external managers during the year. We have invested in the best of these opportunities to enhance the positioning and balance of the overall portfolio and sow the seeds for future growth….”

Continued Caution

Realizing those anticipated returns, of course, may be a choppy business. The external economic environment and political uncertainties (ranging from the continuing European debt crisis to China’s leadership transition and the impending “fiscal cliff” after the U.S. election) continue to make for volatile markets—from which long-term opportunities may arise.

As Mendillo concluded her report:

This is a time of unusual turbulence with significant macroeconomic issues facing regions around the world. While future returns may be uncertain, our strategy is to remain well diversified and focused on long-term value creation.

Read the University news release here.