The University reported a $130-million operating deficit in fiscal year 2011, ended last June 30—about 3 percent of total expenditures—according to its annual financial report (released October 28). In conversation, vice president for finance and chief financial officer Daniel S. Shore noted that Harvard was “still adapting our operations” after the financial crisis in 2008, the ensuing recession, and the $11-billion decline in the endowment in fiscal 2009. The Corporation subsequently reduced the endowment distributions supporting Harvard’s operating budget, cutting its largest revenue source.

Shore said Harvard is enhancing efficiencies and reducing costs “with urgency, but a thoughtful urgency”: multiyear transitions to a new administrative structure and processes for the library system, and consolidated information-technology operations. The changes also include making “very significant progress” on measures to lessen financial risk by moving toward a better debt structure and greater liquidity overall. Revenue growth, he expects, will “continue to be sluggish” even as the University increases spending on urgent priorities: from financial aid to new academic and research programs for which permanent funding has not yet been secured.

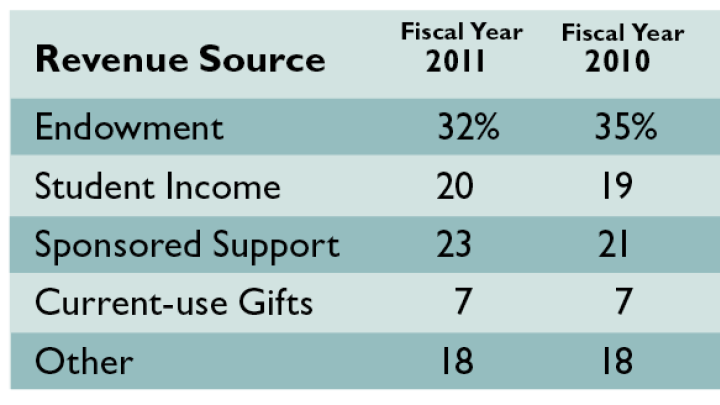

Revenue. For fiscal 2011, revenue increased 1 percent to $3.78 billion, from $3.74 billion in the prior year. Sources included: a $66-million (nearly 11 percent) increase in federally sponsored research support, to $686 million; a $29-million gain in student tuition and fees—after taking into account increases in financial aid; and the 12 percent increase in current-use giving (to $277 million). In the aggregate, those factors increased revenue by $124 million—nearly offsetting the $129-million decline (nearly 10 percent) in the endowment distribution for operating purposes. Harvard’s revenue sources continue to shift significantly (see table above).

Such shifts raise fundamental questions about University finances, as highlighted by President Drew Faust’s summary in the report: “Changing financial realities require an ongoing examination of our funding model with its reliance on government support, endowment returns, and tuition—all of which are expected to be either declining or constrained in the years ahead.” Hence the emphasis in the financial overview, prepared by Shore and University treasurer James F. Rothenberg, on “pursuing a number of strategies that will help to reduce ongoing costs and enable high-priority reinvestment in the years ahead”—and on pursuing additional, more diversified, sources of revenue.

Expenses. In fiscal 2011, expenses rose a reported $168 million—about 4.5 percent—to $3.91 billion. Compensation costs rose $92 million, with salaries and wages $57 million higher (4 percent)—as the fiscal 2010 freeze ended, staffing grew along with sponsored-research grants, and some additions were made in faculty and other ranks—and benefits costs swelled 8 percent ($35 million). Debt-service costs went up $33 million, to $299 million, reflecting a higher volume of debt outstanding and a shift from floating- to fixed-rate obligations.

Shore said that, despite cost-cutting, the University “can’t keep [growth in] expenses below the rate of inflation indefinitely” (and some increase is associated with higher sponsored funding for research). Employee-benefit costs, for example, have compounded at a 10 percent annual rate during the past decade. Health benefits for calendar year 2012 therefore introduce significant increases in employee co-payment, deductible, and maximum out-of-pocket spending schedules, particularly for retirees. But he characterized these as “modest,” emphasizing the need for further steps.

The balance sheet. The financial crisis impelled Harvard’s leaders to reduce its exposure to financial risks across the board. In fiscal year 2011, the University:

- further augmented its liquid operating funds (from $300 million on June 30, 2008, to $1 billion on June 30, 2010, and $1.1 billion last June 30), rather than investing almost all of them alongside the endowment;

- trimmed variable-rate bonds, notes, and commercial paper outstanding from $2.4 billion (62 percent of $3.8 billion of obligations) at the end of fiscal 2007 to just more than $600 million (less than 10 percent of the total $6.3 billion of debt outstanding) at the end of fiscal 2011, sharply reducing exposure to interest-rate spikes or short-term borrowing problems; and

- pared its interest-rate swaps, paying $278 million to terminate more of the agreements that triggered a $1-billion loss in fiscal 2009, and ending fiscal 2011 with remaining losses locked in at about $400 million.

Meanwhile, Harvard Management Company continues to work down its uncalled capital commitments (to convey funds to outside firms for future investment)—from $11 billion in fiscal 2008 to $5.4 billion in fiscal 2011.

The outlook. During fiscal 2011, Shore said, Harvard funded its operating deficit with “accumulated surpluses…earned in the past”—a “bridging mechanism” while long-term measures to reduce expenses are being fully implemented and revenue growth remains very low, allocations for financial aid and other priorities increase, and planning proceeds for a capital campaign that (it is hoped) will provide permanent support for such initiatives.

Near-term, compensation costs are likely to increase, but interest costs should level off. Meanwhile, after two annual reductions in endowment distributions, the Corporation authorized an increase in the current year (approximately 4 percent—perhaps $50 million to $70 million in increased revenue). A further modest increase is planned for fiscal 2013, beginning July 1; the amount has not been disclosed.

But research funding may in part offset these increases. Harvard grants from the federal economic-stimulus program totaled $240 million. Through last June 30, $134 million had been spent, with the remainder to be used chiefly in fiscal years 2012 and 2013. Harvard researchers’ success in winning new grants will determine whether sponsored funding continues to augment or depress the top line. (Through the early months of the current fiscal year, Shore indicated, grant awards continued to increase.)

Putting the pieces together, Shore said he would be happiest knowing that operations would break even this year, but too many uncertainties exist to predict that. (Typically, institutions mounting capital campaigns like to present balanced budgets: donors don’t want to fund deficits.) He noted that Harvard’s plans take into account “continuing pressure on the capital markets” that might harm the endowment; “continuing pressure on the federal budget” that could limit research funding, nonprofit tax-exempt status, and the taxdeduction for charitable giving; continuing local community needs, with implications for taxes and spending; “big, fixed-cost infrastructure” expenses common to research universities, “with elements of deferred maintenance” and modernization of facilities; and, within the Harvard community, the sense that recent robust endowment returns imply a “back to normal” environment, when in fact the now $32-billion endowment remains one-sixth smaller than its value in fiscal 2008—and the operations it then funded have not been fully resized. And the University, he said, “certainly would not add material amounts” of debt to its current borrowings.

Accordingly, Shore said, “We need to do a whole menu of things to help stay financially robust,” from planned administrative improvements, to better control of benefits costs, to exploring “all kinds of new revenues,” to the philanthropic support a campaign would encourage.

For a more detailed report, see http://harvardmag.com/2011-deficit.