Concerns about the compensation of chief executive officers and other top executives of American public companies have reached fever pitch since the financial crisis and the economic meltdown of 2009. Some observers blame the recent recession in part on the flawed compensation arrangements for the top management of major financial institutions. Nor are such concerns new. For almost 20 years, a growing chorus of voices--including some shareholders, the business media, policymakers, and academics--have been criticizing the way top managers are paid. The criticisms focus particularly on CEOs not only because they are the highest paid, but also because their compensation sets the pattern for executives beneath them.

Like previous criticisms, the current complaints focus on two issues: executives are paid too much, and current incentive-pay schemes are flawed because the connection between executive pay and company performance is mixed at best--and at worst has led to a series of dysfunctional behaviors.

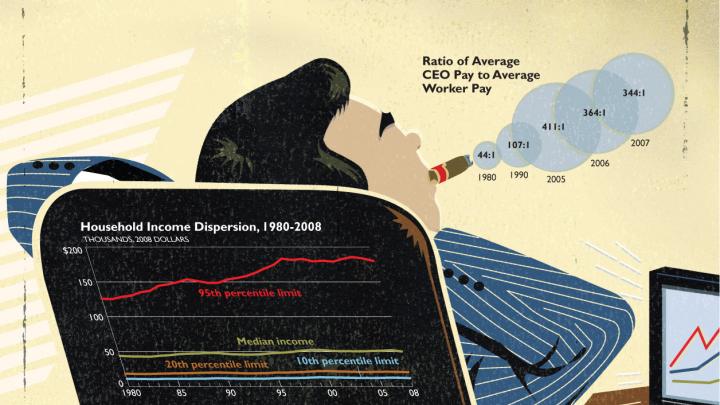

Whether executives are paid too much is highly contested. Some institutional shareholders, politicians, and the public (as measured by opinion surveys) believe that CEOs are overpaid, while other shareholders, board members, and executives themselves disagree. What cannot be disputed is that American CEOs make more money than CEOs in other countries, largely because of a greater reliance on incentive pay (see the details in the chart above). Further, American CEOs are paid increasingly large amounts relative to the average employee and their immediate subordinates. Finally, it is clear that the rise in executive pay contributes to the skewing of income distribution in the United States.

Less clear is evidence about the link between executive compensation and performance. The most comprehensive survey examining the link between CEO pay and performance found that changes in firm performance account for only 4 percent of the variance in CEO pay.1 This may in part reflect CEOs’ ability to game the system, or even the perverse effects of incentives that promote dysfunctional behavior.

The solutions offered for the problems of excessive levels of executive pay and the need to strengthen the link between pay and performance often hit on the same themes: strengthen the independence of directors and compensation committees; increase the shareholders’ rights to elect directors and to express their views on compensation plans, to discourage gaming and align incentives more closely with the aims of the owners. It is also tempting to suggest that these problems can be solved by better compensation schemes or improved techniques to link CEO pay to stock performance.

We disagree with the premises underlying these remedies. Instead, we find that the current compensation trouble stems in large part from unexamined assumptions that have fundamentally changed the nature of executive compensation and radically shifted the way that boards, executives, and even the larger society regard the corporation and its broader purpose.

In fact, the problems of executive compensation are symptomatic of larger societal questions. They cannot be resolved without considering the purpose of executive compensation--what behaviors, attitudes, and values we are trying to motivate in our business leaders--and indeed the larger purpose of business in American society. We assert that the current approach to executive compensation is an outgrowth of a pervasive paradigm that boards, senior executives, and indeed even those of us educating future and current business leaders have adopted about the purpose of the corporation, what it means to be a business executive, and to whom and for what executives are responsible.

The American Way of Pay

To understand our perspective requires understanding how corporate America arrived at its current compensation policies. In mid-twentieth-century business articles and textbooks, one finds references to executive “salaries”; mention of incentives (in cash, stock, or options) is an exception. As a management professor stated in 1951, “It is usually unwise to have a large proportion of executive pay consist of incentives.”2

Complexity and consultants. But by the 1970s and 1980s, compensation packages for CEOs and other senior executives included more incentives, and those incentives were paid in stock and options as well as cash. These arrangements were often worked out in discussions and negotiations between the CEO and the compensation committee of the board of directors, and then ratified by the entire board. As the complexity of companies and their compensation arrangements increased, a new actor emerged to provide ideas and advice to both executives and corporate directors--the compensation consultant. Because these consultants promoted themselves as disinterested, objective experts, many board members with limited time and knowledge about compensation matters came, not surprisingly, to depend on--and increasingly accept, uncritically--the consultants’ advice.

At the core of that advice was the alleged power of incentive compensation to motivate executives. Directors often found themselves sympathetic to such an idea, and perhaps also were compromised about the basic premises behind CEO pay by the fact that they were often active CEOs themselves. But the advice about the importance and efficacy of such incentives was based more on the power of an idea than on clear empirical data. Moreover, the consultants had their own reasons to keep their client executives happy. As Arch Paton, a McKinsey partner and compensation expert explained in 1985, “For their part the consultants like to satisfy this well meaning desire of the executive and frequently have substantial other income from the client to protect. This could create a conflict of interest[,] for consultant recommendations below the expectations of the executive might not be well received. Further[,] as time goes on[,] the consultant may come to regard the executive as his client rather than the company.”3 [Emphasis added.]

The motivation model. The underlying assumption that executives would work more effectively if their monetary rewards were tied to the results they were achieving built on earlier ideas about incentives for factory workers, sales representatives, etc., that go back to the piece-rate schemes advocated by Frederick Taylor and other proponents of Scientific Management. But these prescriptions missed two complications when applied to senior executives:

• that very often executives have little or no control over the results they are supposedly being rewarded for achieving; and

• that the results of a company are more often produced by a group of executives or even by an entire organization’s effort, and only rarely by a single individual. Although some scholars had pointed out that incentives work only when individuals had a clear “line of sight” between their efforts, the results achieved, and the rewards being offered, such complications were increasingly ignored as boards accepted the consultants’ assumption about what motivated executives.4

A related and equally unexamined assumption was that executives worked primarily for money. Such rewards as future promotions, the intrinsic satisfaction of achieving results, and the pride taken in belonging to a successful company were overlooked and sometimes denigrated. Even for American business executives who value the “almighty dollar” so highly, these other rewards have important meaning. That is another reason for our strong reservations about whether the heavy reliance on incentive compensation delivers the results that its proponents believe it does.

The market fallacy. Even as attitudes toward executive compensation changed inside firms, changes related to the larger market for CEOs--and a new intellectual framework about the purpose of the corporation--would complete the superstructure that has governed the executive compensation process for more than three decades.

Increasing turnover in chief executive suites contributed to a belief that there is a robust and well-functioning market for senior executive talent against which compensation needs to be benchmarked. By “robust and well-functioning,” we mean a market in which many buyers and sellers make transactions anonymously. In such a market, what and how an executive should be paid is defined by the supply and demand for the talent she represents. Though there can be little doubt that such a market exists for middle-level executives, there are fewer “buyers” and “sellers” when one considers senior-level executives, and the transaction is not transparent until much later, if at all. Therefore market rates are much harder to identify, and the compensation arrangements in reality depend much more on negotiations between the executive, and usually his attorney, and the compensation committee and its advisers. For senior executives, the most significant determinants of compensation are the negotiating skill and bargaining power of the parties involved. These negotiations cover not only the amounts to be paid, but the form of the compensation, as well as the performance metrics, if any, to which it is to be related.

This flawed assumption about the “market” for CEO talent flows from two factors that have driven up senior-executive compensation.

First, given the idea that there is such a market, compensation consultants have sought a method for making market rates transparent--the much-discussed compensation surveys that establish the “price” of various executive positions by company size, industry, and geography. Not only is the validity of such a methodology questionable, but the surveys also have the perverse effect of “ratcheting” compensation ever upward (to use Warren Buffett’s term). It works like this: The surveys report compensation for a position by quartiles--from highest to lowest amounts. Not surprisingly, compensation committees and their fellow directors prefer the upper quartile. It not only makes the executives feel better, but it looks better in the company’s Compensation Discussion and Analysis (CD&A) in its annual 10-K report to the Securities and Exchange Commission. If the executives don’t want the public to be told they are below average in pay (and presumably performance), neither do many directors and shareholders. That would imply that the board of the company (in which shareholders have invested) believe its performance is below average. As a result, American senior executives are like the children of Lake Wobegon--all above average. Recent papers suggest further that executives game the system of comparisons,5 6 making the benchmark against which they are being judged a moving target that is too often manipulated by the directors, compensation consultants, and even the executives themselves. If the executive’s performance falls short of the original target, it is too often the target that is reset, often surreptitiously in the company’s financial footnotes. 7 8

Although compensation committees and their advisers act in the belief that they are dealing with a market, they actually find themselves involved in negotiations. In numerous papers and books, Friedman professor of law, economics, and finance Lucian Bebchuk and his collaborators have argued that when directors negotiate with an executive, their proposals are constrained not only by their beliefs about market conditions, but also by their bargaining power and tactics. Nowhere is this clearer than in the case of the large lump-sum payments commonly granted to executives, especially when they are brought in from outside the company. These are typically of two types: “make whole” payments (money given to an executive to replace earnings which he will leave behind with his former employer) and “golden parachutes” (money guaranteed to the executive if the company is acquired by or merged into another firm). Both payments are guaranteed regardless of the executive’s performance, unless he or she should be fired for cause (which according to the etiquette of corporate America never happens). Such payments, because of their large size and lack of a link to performance, are another important cause of the rise in top level compensation--and are a major source of shareholder concern.

Yet compensation committees continue to grant these lump sums to new executives, because that is what they believe the market requires to attract the new talent. The idea of bargaining about the size of such payments, or about making them contingent on performance, seems to be off the table.

The behavior of General Electric’s board as it was beginning the process of selecting a successor to the retiring Jack Welch illustrates the elevator effect on pay. Five possible candidates were identified about two years in advance of Welch’s departure. He suggested to the compensation committee and the board that each executive be granted a multimillion-dollar retention bonus to encourage him to stay at GE and compete for the top spot. When directors expressed concern about the cost to GE shareholders of all these bonuses, they were told that they would have to pay only the person who was selected as Welch’s successor: the others were all likely to leave GE to be CEOs elsewhere and their new employers would pay the promised amount as a “make whole arrangement.”9

“Agents” and owners: the primacy of stock. The second factor that transformed compensation was the theory that linked top executives’ pay plans to a firm’s stock price.10 Taking as a starting point the earlier work of Adolph Berle and Gardiner Means, economists Michael Jensen, William Meckling, and others argued that corporate directors and senior executives were “agents” of the company’s shareholders.11 It followed that the goal of boards and the executives whose compensation they set must be to align these agents’ interests with the owners’, most directly by maximizing shareholder wealth. Thus executive incentives should be tied to “shareholder value,” usually measured by the company’s stock price and dividends per share.

Few ideas about business have been as quickly and widely embraced not only by directors and executives, but also by the bankers, consultants, and lawyers who advise them, as well as by the Delaware Court of Chancery. Prominent business organizations switched from advocating a “stakeholder view” in corporate decisionmaking to embracing the “shareholder” maximization imperative. In 1990, for instance, the Business Roundtable, a group of CEOs of the largest U.S. companies, still emphasized in its mission statement that “the directors’ responsibility is to carefully weigh the interests of all stakeholders as part of their responsibility to the corporation or to the long-term interests of its shareholders.” By 1997, the same organization argued that “the paramount duty of management and of boards of directors is to the corporation’s stockholders; the interests of other stakeholders are relevant as a derivative of the duty to the stockholders.”

In applying these ideas to executive-compensation plans, consultants, directors, and the executives themselves had a problem. In most instances, the executives had only partial control over the factors that determined the value of their company’s stock. A company’s past or likely future performance was only one determinant of the current share price; the general stock market level and broader economic conditions also affected shareholder value significantly. The most widely accepted solution to this complication was to tie executive compensation to economic goals seen as drivers of shareholder value (return on assets, return on equity, growth in sales and/or profits, etc.), while paying the executives in stock or in options: a purportedly perfect alignment of interests and incentives.

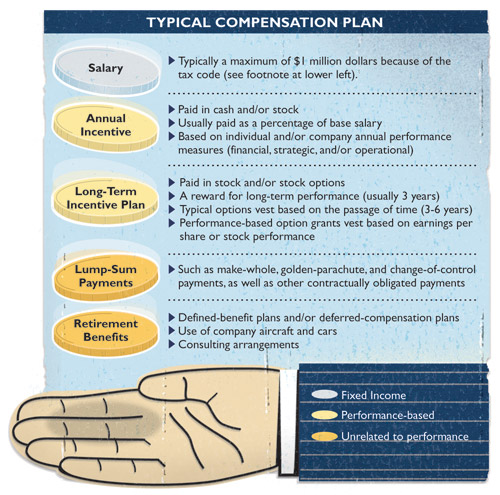

The compensation system. Taken together, these assumptions--which are still widely shared by directors, executives, and those who advise them--have created (with a little help from the IRS12) a near-universal set of beliefs about the components of effective compensation for senior executives (see figure below), as a glance at the CD&A section in the 10K of any public company will show. Those components include a base salary, usually $1 million. There is also a bonus related to annual company performance (usually paid in cash and stock), and a long-term incentive based on three years of company performance, even though in many industries (such as pharmaceuticals) a three-year time frame can hardly be considered “long-term.” Most plans also include the make-whole payments and golden parachutes described earlier. This should not be surprising because a handful of consultants who share these assumptions advise the boards of all major American companies. The validity of “agency” theory has been widely accepted and provides the intellectual underpinnings for many aspects of these plans, even though many of its original advocates have recognized its limits and imperfections!13

Illustration by Stanford Kay. Source: J. Slivanya and K. Powers, “IRS Increases Scrutiny of Performance-Based Plans under Sec. 162(m),” The Tax Adviser, September 1, 2008, 561-562.

The Causes--and Consequences--of Rising Executive Pay

The major causes of the escalating pay for CEOs and other senior executives flow from these assumptions. The most obvious connection is the ratcheting effect of the compensation surveys. Less obvious, but also significant, is the fact that until the downturn in 2008, the economic performance of publicly traded companies had been on an upward trend for a decade or longer. Even though we have doubts that their incentive plans actually motivated managers to act to cause their companies to perform better, if company results improved for any reason (including pure serendipity), the managers received higher pay: cause and effect didn’t matter. What drove incentive compensation up was the company’s performance itself--whether under the control of the CEO and his team or not.

During this same period, the value of shares of U.S. companies was also rising. Because the largest proportion of senior executive compensation is in company stock, as the value of the company’s shares rose, so did the amount of pay the executives received. Finally, wide adoption of lump-sum payments increased compensation still further.

What most troubles us is that executive pay is rising not so much as a driver of improved performance, but as a consequence of improving performance and an accompanying rise in equity values. And as we explained earlier, incentives have impact on behavior only when the recipients can see a direct link from their actions to the results achieved and the rewards they will receive. As we have argued, in most companies multiple forces and the joint efforts of many individuals cause the results achieved. There are circumstances when executives can see an opportunity--a direct connection between actions they can take and results that will produce rewards they desire--but not in the way their companies intend: for example, decisions to cut corners on approving mortgages to earn greater origination fees (and the resulting waves of loan losses and foreclosures), or the decisions taken at Enron to create off-balance-sheet transactions (disguising that failed corporation’s true, deteriorating results). In these circumstances, the potential payouts worked too well, causing executives to take unwise or even illegal actions.

As a society, we understand how to deal with specific transgressions like these by making them difficult or legally risky to carry out. But when the transgressions arise because fallacious assumptions become accepted practices among our business and professional leaders, we seem to have no effective antidotes. The SEC can require greater disclosure about top management compensation in the CD&A--but the likely result is executives comparing their pay with each other to make sure they are being fairly treated. Or Congress can change the tax code (as it did in 1993), so salaries above $1 million would be taxed at an excess rate--but the dubious effect was to put more emphasis on incentive compensation, accompanied by all the problems just described. Congress can call for “say on pay” (a measure adopted in the United Kingdom), thus giving shareholders the right to hold a nonbinding vote on top executives’ compensation--but shareholders are likely to be trapped in the same misleading assumptions as boards have been. We need to rethink how we pay senior executives, and for what, so that they are motivated not only to create wealth for themselves, but also to build companies that serve society.

Revising the American Business Paradigm

The issue of CEO compensation goes beyond absolute amounts and the technical terms defining how executives are paid. Indeed, we believe that the existing approach to compensation offers a poignant commentary on the kind of society we are becoming. Compensation systems always become in part ends, not simply means. By emphasizing particular ends, reward systems condition the behavior and thinking of those people who participate in them or feel their effects. Over time, they shape the business paradigm. And, in turn, because business is such a central institution in American society, they also shape our national culture and character.14 The contemporary pay system is an important part of a radical shift in what we in America regard as the essential nature of corporations, their purpose, and the role and identity of business leaders.

For most of the twentieth century, the large, public corporation was regarded as both an economic entity and a social institution. Shareholders were but one of several constituencies that stood in relation to the corporation.15 Corporate decisions were evaluated not only by their specific economic results, but also with an eye toward their moral and political consequences.16

Today, corporations are typically described in terms of economic and financial considerations alone. Within this dominant paradigm, corporations are seen simply as groups of self-interested market actors--shareholders, employees, executives, or customers--held together by nothing more than a series of contracts.17 These supposedly voluntary contracts define the transactions between executive and employee, for example, in a mutually advantageous way.18 Once the contractually defined exchange is completed, the parties to such a relationship have no further obligations toward each other: they revert to the status of anonymous market actors. But this image of the corporation is problematic: it has nothing to say about the unavoidable fact that organizations are themselves complex social systems.19 Organizational relationships are not merely transactional and fleeting. Over time, they become imbued with affect, content, norms, values, culture, and meaning. Defining the organization as a nexus of individual contracts conveniently dispenses with issues of power, coercion, and exploitation.20 It denies any unique relationship between an organization and other constituents. In all these ways, and more, this model is at odds with more than a century’s research in psychology, sociology, anthropology, and organizational behavior on actual workplace relations. Without empirical justification, it relieves the corporate institution of any meaningful responsibility to anyone but the transitory group of stockholders who buy and sell shares constantly.21

We need to change the terms of the conversation, to make room for a larger and more public discussion about the purpose of the corporation and larger moral and political considerations. Every corporation is embedded in a social matrix, and is accountable for multiple factors within that social setting: obligations to the society that provides it tax advantages or public goods, such as public schooling, publicly financed research, or basic infrastructure such as roads and airports.22 In a democratic society like the United States, the general public expects responsible and ethical practices and the exercise of self-restraint among business leaders in exchange for vesting an extraordinary amount of power that affects society’s well-being in private, corporate hands.23 Indeed, the primary problem in this perspective is the agency problem we described earlier, in which all the actors are trying to protect themselves from the self-interested actions of everyone else.24

As part of that broader public conversation, we also need to revisit what has happened to the identity of management and what it means to be a manager. In part, we believe that the perspective and practices that now undergird executive compensation have themselves mutated the identity of managers fundamentally. At places like Harvard Business School, the prevailing paradigm regards managers as relentless, self-interested free agents ready to make tracks out of their companies and to sacrifice the long-term for immediate gain. That view has largely displaced earlier views of managers as professionals with obligations to various “stakeholders” and to the broader society.25 The dominant ethos today also legitimates the notion that human beings are relentless market maximizers who need literally to be bribed to focus solely on shareholder value--undermining other commitments managers might have to employees, customers, the community, or larger national and global concerns such as the environment or human rights.

Both of us have dedicated our professional lives to business education; we believe deeply in the power of profit-driven business as an institution. But business is useful only if it serves as a means toward an end. We are now presented with choices about sustainability, pandemics, economic and social justice, and the environment that concern nothing less than our collective destiny. The technical forces in play, the global interrelations, the destructive effects on the real economy of badly managed and largely speculative financial dealings, the unrestrained exploitation of our planet’s nonrenewable resources--all of this should lead us to reflect on the type of capitalist system we have created and the types of people who are leading it.26

The recent economic crisis and the role that our compensation systems played in fomenting it require a holistic re-examination not only of compensation but of the assumptions and values underlying the economic system we have created. Our present condition offers us a unique opportunity to re-envision our journey and our ultimate destination. Re-thinking the nature of executive pay within the context of our larger economic and social system and the challenges we face may enable us to create a new model of compensation rooted in a more realistic recognition of the social context within which firms operate. It should, and can, rest on valid assumptions and fundamental values that allow us to build a more inclusive and sustainable economic future--one in which we don’t have to bribe executives to do the duties we have entrusted to them.