On September 19, Harvard Management Company (HMC) CEO N.V. Narvekar reported an 8.1 percent investment return on endowment assets during fiscal year 2017, ended last June 30, observing bluntly, “Our performance is disappointing and not where it needs to be.” Although the positive return (after investment expenses) reverses the prior-year negative 2.0 percent return, HMC’s gains substantially trailed peers’ reported results. Taking into account the investment return, the distribution of funds for the University’s operating budget, and gifts received, the endowment was valued at $37.1 billion at the end of the fiscal year, up 3.9 percent from $35.7 billion at the end of fiscal 2016—but barely above the peak value (not adjusted for inflation) of $36.9 billion at the end of fiscal 2008, before the financial crisis and recession.

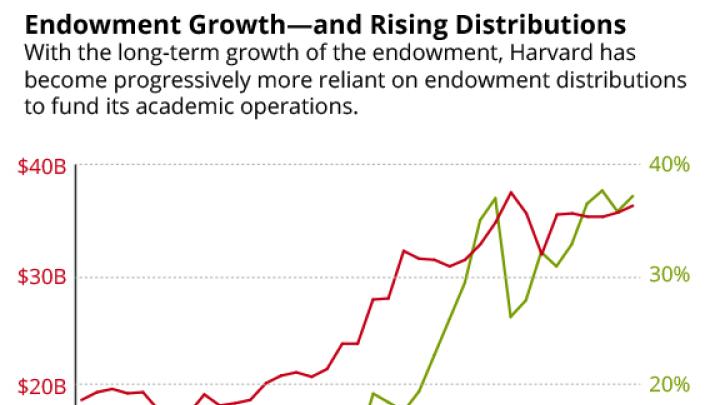

The University is growing (Harvard’s expenses were $4.7 billion in fiscal 2016, up from $3.5 billion in fiscal 2008), and its financial model assumes a rising stream of funds available for distribution from the endowment each year. Of late, that distribution has accounted for 36 percent of Harvard’s operating revenue—about as much as the next two sources, sponsored research support (21 percent) and tuition and fees (17 percent), combined. In the meantime, inflation erodes the endowment’s value (to the tune of $5 billion in lost purchasing power during that period; see harvardmag.com/congress-queries-16). So it is especially worrying that tepid investment performance is sapping endowment growth even in nominal terms, especially during the recent robust gift-giving, spurred by The Harvard Campaign, which has augmented endowment funds by several hundred million dollars annually.

Narvekar was appointed CEO in September 2016 and arrived at HMC last December, charged with overhauling the organization and its strategies to overcome persistent underperformance (see harvardmag.com/narvekar-16). Through the end of fiscal 2016, HMC’s average annualized investment return for the prior decade was 5.7 percent, well below the University’s 8.0 percent planning assumption. That goal, if achieved, would accommodate distributing about 5 percent of endowment value each year, to pay for teaching and research, and earning a 3 percent margin to offset inflation, thus preserving the endowment’s purchasing power. On an endowment corpus of $37 billion, falling 2.3 percentage points short of the return objective amounts to about $900 million of unrealized endowment value in a single year—a sum that compounds with reinvestment.

Narvekar’s initial annual report explained HMC’s recent results in broad terms, and then sketched the sweeping actions under way that are intended to boost performance in the long term.

- Recent results. During fiscal 2017, he wrote wrote, “Performance reflects strong returns from public equity, private equity, and our direct real-estate platform, while natural resources experienced a challenging year.” That general comment on public- and private-equity and real-estate results was consistent with other endowments’ reported returns: 14.6 percent at Dartmouth, 12.4 percent for the University of Virginia, and 14.3 percent at the perennially strong MIT, whose endowment has grown from $9.9 billion at the end of fiscal 2008 to $14.8 billion now. (Princeton, Stanford, and Yale, peers with similar endowments, had not reported results by the time this issue went to press. Updated 10/5/2017: See harvardmag.com/peer-results-17 for additional results.) During the year, according to the Wilshire Trust Universe Comparison Service, median returns for large endowments were in the range of 12 percent to nearly 14 percent.

What accounted for the shortfall at HMC? Narvekar didn’t say. Ending past practice (see the fiscal 2016 reporting format at harvardmag.com/endowment-drop-16), he will no longer detail how the endowment is invested, returns by asset class, performance versus market benchmarks—or, apparently, even five- and 10-year rates of return. That decision reflects internal changes under which HMC intends to manage the endowment as a whole, rather than by discrete asset classes (see below). But it does make it more difficult for outside observers to have a sense of the operation; for instance, since the rate of return is calculated on a time-weighted basis (reflecting when HMC disburses funds to the University and when gifts are received), external analysts will no longer be able to calculate long-term rates of return that are comparable to the prior format, unless the management company decides to do so in the future.

The University’s annual financial report, published each autumn (after this issue closed), may provide further guidance. It details the investment return (perhaps $2.5 billion to $3. billion this year), the operating distribution (perhaps $1.8 billion), and gifts received (perhaps $500 million), yielding the $1.4-billion growth in endowment value during the year. It also shows assets by category for the General Investment Account, which does not align exactly with the endowment.

At the end of fiscal 2016, natural-resources holdings were valued at $3.6 billion. Narvekar observed that for years HMC’s internally managed program “generated strong returns” (investing in timberland and related assets, for instance). “At this stage,” he wrote, “while most assets remain attractive, a few have significant challenges” and the board of directors “took some markdowns on value prior to my arrival, and we have taken more markdowns in fiscal year 2017, which meaningfully impacted our results.”

Absent any quantification from him and whatever information may be gleaned from the forthcoming financial report, if HMC wrote down natural-resources assets by 30 percent in fiscal 2017, that would reduce reported returns by about $1 billion—enough to reduce the total investment return by about 3 percentage points. Nor did HMC break out additional one-time restructuring costs—such as severance payments or losses (if any) on the sale of some private-equity and real-estate investments late in the fiscal year—that may have affected the reported investment return, and therefore the value of the endowment, this year. (Given the endowment’s size, any such costs, if incurred, may not be material, and therefore may not have to be reported.)

As a back-of-the-envelope calculation, an estimated natural-resources write-down and the other expense factors might imply a 3-percentage-point penalty, leaving HMC’s 8.1 percent reported return still 2 to 3 percentage points behind the best peers’ results. Although Narvekar emphasizes that raw investment performance is not the right comparative metric, since each institution’s risk tolerance, investment aims, and portfolio must be tailored to its own objectives and financial needs, he still characterized HMC’s result as disappointing. Hence the need for corrective action.

- Restructuring report. This past January, he signaled sweeping changes in HMC’s organization and strategies—including significant reductions in personnel and the hiring of new senior managers (details available at harvardmag.com/hmc-overhaul17). He signaled then that “transforming HMC’s organization and portfolio is a five-year process.”

His September report indicates the scope of the overhaul he has undertaken, proceeding from his conclusion that “The endowment’s returns are a symptom of deep structural problems at HMC and the resultant significant issues in the portfolio. These matters have challenged HMC for years….”

Outsiders may be surprised by the scope of the resulting changes. In a take-your-breath-away summary paragraph, Narvekar wrote that since “the time had come for an aggressive plan to restructure HMC and create the necessary organizational and investment culture,”

[M]y first seven months included establishing a generalist investment model, recruiting new senior investment team members, integrating existing team members from the previous silo model and new team members (including myself ) into our generalist model, spinning off various internal platforms and preparing to spin off others, rebuilding our investment processes and analytics, creating a new risk framework, generating meaningful liquidity, and designing our new compensation framework.

When these changes are fully effected, the endowment will be entrusted to a small team of senior professionals—perhaps a couple dozen in all—discussing opportunities and risks across the universe of investment options and making commitments for the endowment as a whole. (See a detailed report at harvardmag.com/hmc-summary-17.)

Those new HMC investment professionals will have to establish new relationships with external money managers—a pressing priority after the many changes in HMC’s leadership during the past decade, and its investing constraints in the wake of the large endowment losses in 2008 and 2009. Moreover, illiquid assets are customarily tied up for multiyear periods (the time it takes for a private-equity investment in a company to be made and sold, or to develop and lease a real-estate development). Even with the sales of assets effected last June to provide liquid funds for new investments, there is a limit to the volume of commitments Narvekar and his team can and would confidently make in the near term. From external managers’ perspective, too, it can take years to put newly raised funds to work. So the transition period he invoked last winter may well extend beyond the five-year interval he sketched.

In the meantime, HMC’s board and the Harvard Corporation will have to define the University’s risk tolerance. Harvard differs significantly from peers like Penn, Stanford, and Yale, which own and operate large hospital systems; and from Princeton, given its minuscule professional-school component. And at some point, Narvekar, his board, and the University will have to determine whether it is realistic to project long-term annualized returns of 8 percent. The stakes are significant: reducing the return assumption to 7 percent could imply a 20-percentage-point reduction in the funds distributed to the faculties (from 5 percent of the endowment market value to 4 percent): a shock if imposed suddenly, or a longer-term concern if phased in over time.

All those issues loom over HMC’s restructuring. “In a perfect world,” Narvekar wrote, “we would have moved through these changes over a much longer period. However, given the time needed for these changes to impact results, the HMC board of directors and I strongly believe that HMC will be in a far better position by moving quickly. We have done so.”

Given fiscal 2016 investment losses and tepid 2017 returns, deans will receive level endowment distributions next year, and expected minimal gains in fiscal 2019. To ease the pain, the Corporation has decided to budget 2.5 percent to 4.5 percent increases for fiscal 2019 to 2021, beginning with the lower figure in the first year—stabilizing guidance during Harvard’s presidential and HMC’s transitions.

In light of the leverage represented by enhancing HMC’s returns over time—and the fundamental importance of those returns to the University’s academic mission—Narvekar and his colleagues continue to have the most important financial jobs at Harvard.