Highlights for fiscal 2019:

•The endowment’s value was $40.9 billion as of this past June 30, the end of fiscal year 2019—an increase of $1.7 billion (4.3 percent) from $39.2 billion a year earlier.

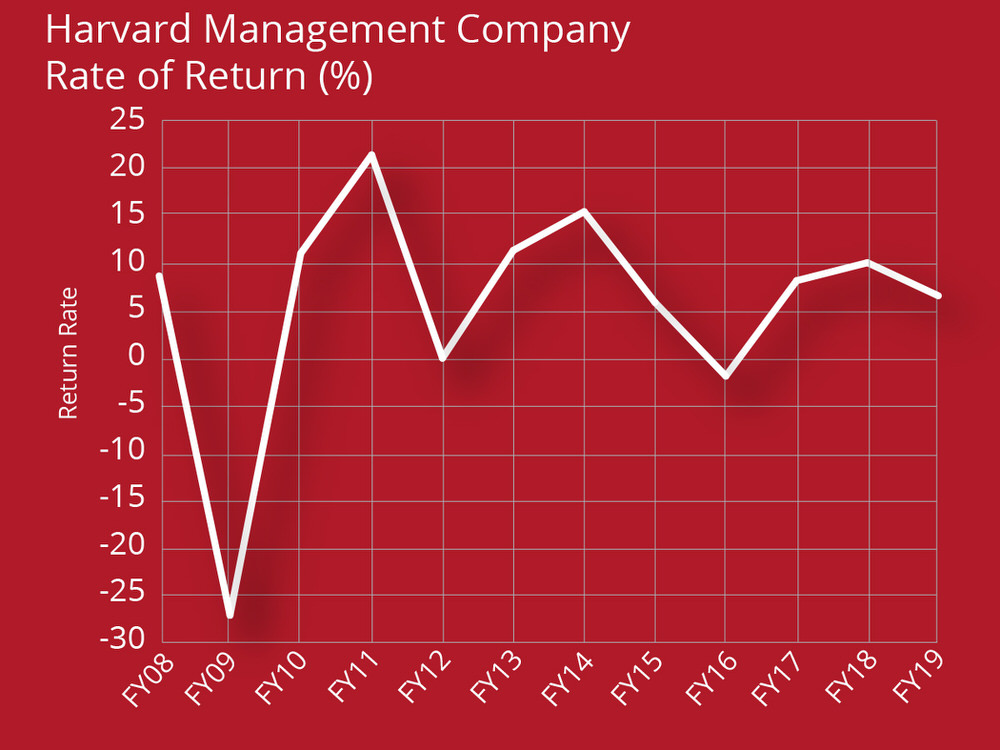

•In a year when other institutions’ endowments are reporting more modest returns than in prior periods, Harvard Management Company (HMC) recorded a 6.5 percent return on endowment assets during fiscal 2019: down from the 10.0 percent return recorded during the prior year. (The return figures take investment expenses and fees into account. HMC has not detailed internal restructuring costs or the magnitude of asset impairments and revaluations recorded during its recent makeover, so it is unclear whether current or prior-year results are affected by such factors.)

•HMC’s most recent investment results trail those of some other institutions that have reported to date (see below). When others report, it appears that HMC’s results for the year will be somewhat below the return achieved by its closest peers (Updated September 28, 2019, 8:50 a.m.: But see Yale’s surprisingly weak results, below), in part reflecting the anticipated multiyear transition in its portfolio under its current management. When applied to an asset pool the size of the Harvard endowment, every percentage point of over- or under-performance relative to the University’s long-term goal or HMC’s portfolio benchmarks translates into hundreds of millions of dollars more, or less, in annual investment gains available over time to support academic operations—the factor driving the new HMC managers and the strategies they are effecting.

•Today’s results are just the headline, aggregate figures. HMC president and CEO N.P. Narvekar provided this succinct comment:

We are now halfway through our five-year transition of both the structure of HMC and the University’s investment portfolio. I am encouraged by the progress our team has made to date, but we are mindful that there is much left to accomplish in the years ahead to resolve legacy issues and position the endowment for long-term success.

Following the precedent established last year, detailed reporting on HMC’s investment returns by asset class, and other performance metrics, are now published only with the University’s annual financial report for the fiscal year, typically released in mid autumn (on October 25 last year). Check back at www.harvardmagazine.com for a comprehensive report on the fiscal 2019 HMC data and Harvard’s finances, when they become public.

As always, the change in endowment value reflects three intersecting factors:

- the investment return (positive this year);

- the regular distribution of funds—a withdrawal from the endowment, to support Harvard’s operations—and possibly other one-time distributions, so-called decapitalizations; and

- the gifts added to the endowment, as pledges are fulfilled and proceeds received—the fruits of The Harvard Campaign, concluded June 30, 2018—and any subsequent gifts for endowment made in time for inclusion in fiscal 2019 results. (Harvard includes pledges in the endowment total it reports—$0.9 billion of the $39.2 billion as of the end of fiscal 2018; some other institutions, including MIT, exclude pledges from the endowment values shown in their financial reports.

The Endowment’s Value

HMC, which invests the University’s endowment and other financial assets, announced today that during fiscal 2019, the endowment’s value increased 4.3 percent, to the reported $40.9 billion; during the prior year, its value had appreciated 5.7 percent, to the reported $39.2 billion. Thus, in absolute terms, the endowment’s value increased $1.7 billion during the fiscal year just ended (not adjusted for inflation). It is the growth in real, inflation-adjusted value over time that goes a long way toward determining how much the University can increase spending on its academic mission (hiring faculty members, providing financial aid, running libraries and laboratories, etc.).

The change in the value of the endowment reflects the intersection of:

Appreciation. HMC’s money managers—primarily external investment firms—realized an aggregate 6.5 percent investment return (realized and unrealized; after all expenses), producing an increase in value of perhaps $2.6 billion. (Transfers and timing differences—when funds are received and disbursed—figure in the final rate-of-return calculation and reported endowment value; exact figures await publication of Harvard’s annual report later this autumn, as noted.)

Distributions. Harvard’s endowment exists to provide a permanent source of capital, investment earnings from which funds can be distributed to pay for University operations. Such distributions reduce the endowment’s value. In fiscal 2018, those distributions, slightly more than $1.8 billion, accounted for 35 percent of the funds used to operate Harvard—by far the largest source of revenue. The comparable figure for fiscal 2019 again awaits publication of the annual financial report, but the distribution (as determined by the Harvard Corporation) likely grew from the prior year.

As reported previously, in light of weak investment returns earlier in the decade, the Corporation held the distribution flat (per unit of endowment owned by each school) for fiscal 2018, and suggested that distributions could increase within a range of 2.5 percent to 4.5 percent annually for fiscal 2019 through 2021 (the first year of the new University presidency, and during HMC’s continuing strategic transition); it also announced that distributions per unit would increase 2.5 percent in fiscal 2019. The number of units each school owns changes, as they receive gifts or transfer funds into their endowment accounts, so the absolute dollar sum distributed to them typically rises more than the percentage change in the per-unit distribution rate each year. A back-of-the-envelope calculation therefore suggests that funds distributed in fiscal 2019 increased by perhaps 4 percent to 5 percent in fiscal 2019, bringing the total to roughly $1.9 billion.

Gifts. The value of the endowment is augmented by capital gifts received each year: fulfillment of pledges made during prior years (as in The Harvard Campaign), and other capital funds given during the current year. At the end of fiscal 2018, some $936 million in outstanding pledges for endowment gifts were reported in Harvard’s financial statements; it is likely that a portion of those promised funds was actually fulfilled in fiscal 2019, boosting the endowment. The first year of Lawrence S. Bacow’s presidency was also marked by at least four nine-figure gifts:

- an anonymous $100-million gift to support science and mathematics within the Faculty of Arts and Sciences (FAS), some or all of which likely is endowed;

- a $200-million gift for biomedical research, apparently meant for spending on operations, rather than endowment;

- a $131-million gift for bioengineering, again apparently for operating funds; and

- a $100-million gift to build a new theater complex in Allston, which will be spent in time, (although a portion dedicated to renewing and supporting FAS’s Loeb Drama Center might be endowment funds).

Though those funds seem intended, for the most part, to pay for current or relatively near-term operating and building needs, until they are so deployed, they might generate some investment income. But it is likely none of them made a significant difference in the reported value of the endowment as of last June 30. The annual financial report will tell the tale; assume for now that fiscal 2019 gifts for endowment received were $1 billion, up from the $646 million reported in the prior year—and check back later in the autumn for the actual sum.

Thus, the rough calculation would be:

- $39.2 billion beginning value as of July 1, 2018,

- plus $2.6 billion (fiscal 2019 investment gains),

- minus $1.9 billion in operation distributions for the University budget (with no estimate made for nonoperating “decapitalization” distributions),

- plus perhaps $1.0 billion in gifts for endowment received,

- equals the endowment’s reported $40.9-billion value as of this past June 30.

Discussion and Outlook

The year ended June 30 was a confounding one for many institutional investors. U.S. stocks plummeted during the first half of the year, and then rebounded. World equity market indexes showed a return of 6 percent or so. Given slowing world economic growth, some natural resources (oil and gas, metals, timber) sank in value. And some of the safest havens—conventional fixed-income assets, like government bonds, mostly disfavored by sophisticated, long-term investors like large university endowments—soared in value as interest rates plunged with lowered expectations for economic expectations (causing the value of bonds themselves, and thus their total return, to appreciate): bond returns were, by some indexes, higher than those for stocks.

The Wilshire Trust Universe Comparison Service, prepared by Wilshire Analytics, reported median annual returns for large foundations and endowments of somewhat more than 5 percent. (Its definition of “large” is asset pools of $500 million or more, implying very different needs, opportunities, and portfolios than those managed by HMC and Harvard’s largest peer institutions—but this is at least modestly useful as a proxy for endowment assets.)

Among schools that have reported results (thus far excluding Yale, Stanford, and Princeton, whose portfolios are HMC’s closest cousins):

- MIT, habitually an outstanding performer, had an 8.8 percent return, down from 13.5 percent in fiscal 2018, and its endowment was valued at $17.4 billion, up 6 percent.

- Dartmouth earned 7.5 percent on its smaller endowment (down from 12.2 percent in the prior year), increasing its value to $5.7 billion, up a bit less than 4 percent.

- The University of Virginia, a consistently strong performer, reported a 5.8 percent return on its long-term pool, down from 11.4 percent in fiscal 2018. Its best-performing asset class was private equity (up 21.9 percent ); resources holdings depreciated by 10.5 percent; and fixed-income holdings appreciated 6.6 percent, out-earning public stock investments (6.1 percent). The long-term pool increased $0.1 billion in value, to $9.6 billion, a gain of 1 percent.

Updated September 28, 2019, 8:50 A.M., for Penn and Yale results:

- The University of Pennsylvania reported a 6.5 percent investment return on its endowment for fiscal 2019, down from 12.9 percent in the prior year.

- Yale reported a 5.7 percent return for fiscal 2019 (and an endowment value of $30.3 billion, up from $29.4 billion)—down from 12.3 percent in the prior year and far below its usual strong performance. Yale’s results may reflect its extreme skew away from the public stock and bond markets, where performance was very strong this year, and its end-of-the-spectrum devotion to private and alternative classes of assets. For fiscal 2020, the Yale portfolio allocates just 2.75 percent of assets to the U.S. stock market (versus 13.75 percent to international stocks)—and 23 percent to absolute return (hedge funds), 21 percent to venture capital, and 16.5 percent to private equity.

Updated October 2, 2019, 8:05 A.M., for Stanford results:

- Stanford reported a 6.5 percent investment return for fiscal 2019, down from 11.3 percent the prior year, and an endowment value as of August 31 of $27.7 billion, up from $26.5 billion on the same date in 2018.

Comparisons among institutions need to be drawn carefully. Each institution’s operations, finances, risk profile, and therefore investment strategies and assets are unique, making raw performance comparisons more of a horse race than a rational guide for analysis. (For instance, Yale and Stanford own and consolidate the financial results of their medical schools’ large hospitals; Harvard-affiliated hospitals are separate entities; and Princeton has no such affiliations, nor most of the professional schools that loom large at the other three universities.) Moreover, for an endowment meant to function in perpetuity, investment returns over a year or three matter less than longer-term results—at least over an entire business cycle. For large university portfolios, heavily invested in illiquid alternative assets like private equity, performance is properly measured in multiyear increments. HMC has been redeploying funds heavily within such asset classes during the past two years of restructuring; those investments will not mature for many years, so its reported results may be at a different stage than those of peers with more established portfolios.

Nonetheless, the Virginia results demonstrate two inexorable facts that are important to Harvard and HMC.

First, for institutions like this one that aim to distribute investment earnings equivalent to roughly 5 percent of the market value of the endowment corpus each year, a 5 percent or 6 percent investment return yields little, if any, net growth in the value of the underlying principal (excluding gifts received). Were such results to persist, the real value of the endowment, and thus the academic expenses it could support through distributions, would be eroded by inflation. The April Commonfund estimate for the fiscal 2019 Higher Education Price Index was 2.6 percent. Thus, an institution that had investment returns of, say, 5.5 percent, and distributions equal to 5 percent of the endowment’s market value, would see its future purchasing power reduced by more than 2 percent over the course of that year.

Second, such institutions—Harvard among them—therefore typically aim for long-term endowment investment returns of about 8 percent, allowing for the distribution of 5 percent of market value and returns of 3 percent to maintain, or grow, real future purchasing power. Academic plans and long-term budgets that assume such returns over time are vulnerable if they cannot be achieved sustainably. The persistence worldwide of very low interest rates suggests that investor assumptions about long-term rates of return might well have to be adjusted down, too—at least compared to the rich pickings achieved in the recent past; some of the largest public pension funds have reduced their assumed rates of return to 7 percent or so.

HMC and Harvard are considering what long-term rate of return is appropriate for the endowment managers to expect to earn—which has obvious implications for what kind of academic operations deans can expect the endowment to support. For FAS, for example, income derived from the endowment accounted for 51 percent of fiscal 2018 operating funds. If the economic and investment environment suggests that Harvard’s expected long-term endowment returns are too high—and the labor-intensive processes of education and research do not somehow become immunized against habitual inflationary pressures—the leveraged effect on a faculty like FAS from lower future distributions could be enormous.

Hovering over these considerations, of course, is the new federal excise tax on endowment investment earnings, which Harvard is on tap to pay for fiscal 2019. At last estimate—not updated for U.S. Treasury guidance on how the tax will work, nor for HMC’s latest results—the University faced an annual bill of $40 million or more. Whatever the sum turns out to be, it is effectively a reduction in the investment returns available to distribute to the schools, at a time when realizing planned-for rates of return already appears challenging.

So HMC’s absolute performance matters a great deal to Harvard—and over time, to its relative standing as it competes with other research universities to attract stellar students and scholars. Stay tuned.