Harvard's layoffs of staff members begun last week prompted a labor protest and extended public comment on news-media websites. Meanwhile, communications from deans to faculty and staff members at the affected schools reveal more about their financial situations; and details have emerged about the working groups charged with finding ways to "reshape" the Faculty of Arts and Sciences (FAS) to close its remaining $143-million budget gap, and about the constraints on the University's endowment funds, invested by Harvard Management Company (HMC).

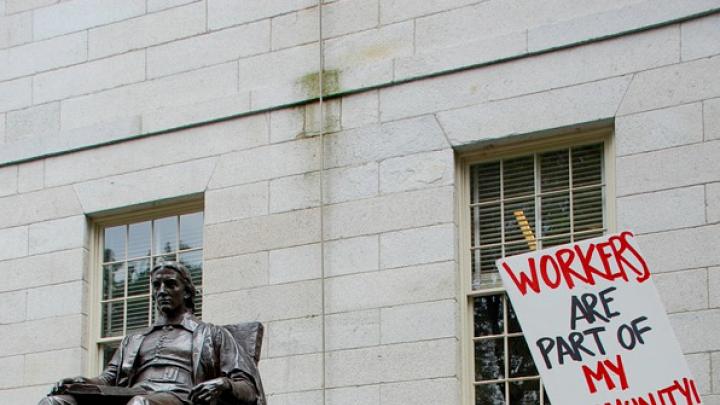

Layoffs. On Thursday, June 25, members of the Harvard Union of Clerical and Technical Workers, other labor groups, student labor activists, and other supporters of the anti-layoff campaign rallied in Harvard Yard (see photo); read the Crimson report on the protest. News accounts of the first wave of layoffs sparked vigorous discourse (see the comments at the Harvard Magazine story), ranging from discussions of endowment management to calls for salary reductions, job-sharing, or reduced work hours to preserve jobs. The Boston Globe article on the layoffs, by education reporter Tracy Jan, attracted a couple of hundred comments, covering the waterfront, many of them harshly critical of the University.

These reactions aside, the individual schools' communications revealed a good deal about their separate financial circumstances, and about the broader measures--apart from the identified layoffs--being undertaken to reduce their costs in reaction to lowered distributions of funds from the endowment and to broad economic pressures.

Harvard Business School (HBS) eliminated 16 positions by laying off those staff members. Of note, HBS had very high participation in the voluntary early-retirement incentive program, with 42 of 103 eligible staff members (41 percent) accepting the offer. Combining the early retirements, layoffs, and other attrition (people who left their HBS jobs for other reasons), the school has trimmed its staff (excluding faculty members) of 1,187 by 80 full-time equivalents (about 6.7 percent), and has trimmed its contractor and temporary-worker population by another 50 equivalent positions: a 130-person decline. HBS relied on endowment distributions for about 20 percent of its revenues in the fiscal year ending June 30, 2008, but student income (particularly executive-education programs for businesses) and its large publishing operation are both sensitive to the recession, with pressure on both those major sources of income.

Harvard Law School (HLS), which relied on endowment distributions for 37 percent of its fiscal year 2008 revenue--about 3 percentage points above the University average--laid off 12 staff members. Together with other measures, including 25 early retirements, elimination of current vacancies, and ending of limited-term appointments, the school indicated that it expected its staff to decline by nearly 10 percent. Endowment distributions to HLS are now forecast to decline as much as $19 million from the level in the fiscal year ending this June 30—more than 10 percent of the current operating budget overall. Acting dean Howell Jackson reported that faculty members and senior administrators have put in place measures to reduce faculty allowances and certain stipends, and to increase the share of teaching conducted by permanent (as opposed to visiting) professors--and noted that faculty and senior administration members have pledged to donate several hundred thousand dollars and have waived other compensation to ameliorate the job cuts.

Despite significant dependence on endowment distributions (39 percent of operating revenue in fiscal year 2008), the School of Engineering and Applied Sciences announced that it would not have to impose any staff reductions. Similarly, the Harvard School of Public Health (the school least reliant on endowment funds, at 13 percent in fiscal year 2008) and most dependent on sponsored-research funding (73 percent of fiscal year 2008 revenues) has been able to get by without making any cost-related layoffs now.

The Crimson reported on layoffs in the Harvard library system.

FAS Restructuring. As reported, the Faculty of Arts and Sciences, having identified $77 million of budget cuts, still faces closing a $143-million gap, a reflection in part of its proportionally very heavy reliance on endowment distributions (which are being reduced sharply in fiscal year 2010 and again in fiscal year 2011) for operating revenue (52 percent in fiscal year 2008, and certainly higher in the year ending this June 30). As announced in April, FAS dean Michael D. Smith has now appointed a half-dozen working groups (all of which will also interact with the Graduate School of Arts and Sciences, whose operations overlap all FAS teaching and research areas) to address the fundamental "reshaping" required to bring the faculty's operations into line with its reduced resources. This is an especially onerous challenge, given that spending on financial aid, debt service, and sponsored research totals perhaps one-third of FAS's expenses, will not be cut, and in fact will each likely grow.

According to a June posting on the FAS planning website, the working groups are "embarking on a process to prioritize [FAS's] academic and intellectual activities to guide further budget reductions and to reshape its programs to be sustainable over the long term." In pursuing their mandates, "The groups exist to both generate informed recommendations, drawing on the latest financial and organizational information, and to delineate clearly the sacrifices we will not make as we size our activities to match our shrinking budgets. Each working group will provide important intellectual principles and academic priorities that will guide further cost cutting efforts. With this guidance in hand, we will be able to evaluate ideas and suggestions generated by all parts of our community for further cost-savings while maintaining the character of our programs, our students, our faculty, and our staff."

The working groups and their chairs are:

- College Student Services, Evelynn M. Hammonds, dean of Harvard College (with members including three students, several student-affairs deans, administrators, and two House masters)

- College Academic, Hammonds (with members including three students, tutors and resident deans, the directors of Expository Writing and of Freshman Seminars, three House masters, and others)

- Arts and Humanities, Diana Sorensen, Rothenberg professor of Romance languages and literatures and of comparative literature, dean of Arts and Humanities (with a dozen full professors as members)

- Sciences, Jeremy Bloxham, Mallinckrodt professor of geophysics and professor of computational sciences, dean of Science (with four full professors as members)

- Social Sciences, Stephen Kosslyn, Lindsley professor of psychology, dean of Social Science (with a dozen full professors as members, their ranks divided into two separate phases, as yet unexplained)

- School of Engineering and Applied Sciences, Frans Spaepen, Franklin professor of applied physics, acting dean until June 30, and Cherry Murray, dean as of July 1 (with both Spaepen and Murray and seven full professors and four SEAS administrators as members).

According to a timeline on the website, the working groups were scheduled to: meet through June; collect and analyze data during the summer months; resume meeting from August into early autumn; begin engaging the community on recommendations as the academic year began and throughout the fall term; and work with the Academic Planning Group (Dean Smith's principal academic deans, the College and graduate school deans, and a few senior administrators), into December to prepare final plans for implementation beginning toward the end of the calendar year, as the fiscal year 2011 budget is drawn up.

Endowment. The cover story in the June 29 issue of Barron's, the financial weekly (online access restricted to subscribers), dramatically titled "The Big Squeeze," details the extent to which the endowments of Harvard, Yale, Stanford, and Princeton are invested in relatively illiquid assets (private equity, hedge funds, real estate, commodities). It further examines the likely performance of each school's endowment, based on their disclosures year-to-date and estimated returns for assets in the class.

Barron's reporter Andrew Bary then calculates the extent to which each institution has made future commitments, through its investment partnerships, to advance funds in the future to the managing partners for those assets (in real estate, private equity, and so on). By Bary's calculation, Harvard has $11 billion of future commitments to such investment partnerships (as disclosed in its annual financial statements and reported in Harvard Magazine; these commitments extend over the next decade), and an endowment now valued at $25 billion. Bary calculates that Yale has $8.7 billion of future commitments to its investment partnerships, and that its endowment is now valued at about $17 billion; Stanford's future commitments are not disclosed; and Princeton is carrying $6.1 billion of future commitments, and has an endowment now estimated to be valued at $11.4 billion.

The challenge is funding those future commitments at a time when liquid resources are limited--not least because existing investments in those asset classes are not generating cash distributions to Harvard and other limited partners (or at least not in any significant volume). For more discussion, see this background posting from Harvard Magazine on the University's debt issuance last December, and this report on a recent Moody's analysis of University finances. HMC does not describe its investment strategies, and is not expected to report on fiscal year 2009 results or asset allocations until early September.

Not previously reported (and not in Bary's article), is the very rapid growth in in Harvard's forward commitments in recent years. According to University financial statements, at the end of fiscal year 2005, the endowment was valued at $25.9 billion, and future commitments to investment partnerships during the ensuing decade totaled $3.4 billion; in the next fiscal years, the comparable figures were, respectively:

2006: $29.2 billion and $7.2 billion

2007: $34.9 billion and $8.2 billion

2008: $36.9 billion and $11 billion

This suggests a proportionally increasing appetite for investments in these (as it now turns out) relatively illiquid asset classes from mid decade on, as the endowment itself appreciated continuously. Thus, as the endowment value grew 42 percent during this period, future commitments to investment-managment partners for each following 10-year interval more than tripled.

Year-end financial reports will reveal how accurate Bary's estimates prove to be. But his reporting appears to have identified a central issue in these and similar institutions' investment challenges going forward. They must strive to maintain above-market returns in what have historically been very productive asset classes, while balancing their parent institutions' need for liquidity--particularly in light of lessened endowment distributions to pay for academic operations, at the same time that adverse economic conditions are expected to restrain income from tuition, philanthropy, and sponsored-research funding.