In light of continued strong investment returns (see "Endowment Gains: Last Hurrah?" November-December 2004, page 56), the Harvard Management Company (HMC) investment professionals who contributed most significantly to the University's fisc again earned commensurately significant bonuses in the fiscal year ended last June 30. Domestic bond-fund manager David R. Mittelman was paid salary, benefits, and bonus totaling $25.4 million; Maurice Samuels, responsible for foreign bonds, received $25.3 million. Their even higher earnings in the fiscal year ended June 30, 2003, prompted debate about the appropriateness of HMC's compensation formula, the most cost-effective way to maximize Harvard's endowment returns, and broad questions about rewards for service within a nonprofit enterprise (see "'Extraordinary' Bonuses," March-April 2004, page 69).

| The Top Tier | ||||

| Manager | '04 Payout* | Performance** | '03 Payout* | Performance** |

| David R. Mittleman (Domestic bonds) | $25.4 | 9.2% vs. (3.4%) | $34.1 | 31.1% vs. 17.3% |

| Maurice Samuels (Foreign bonds) | $25.3 | 17.5% vs. 7.6% | $35.1 | 52.4% vs. 18.0% |

| Jeffrey B. Larson (Foreign equity) | $8.1 | 40.6% vs. 32.6% | $17.3 | (2.8%) vs. (6.2%) |

| Jack R. Meyer (HMC President) | $7.2 | 21.1% vs. 16.4% | $6.9 | 12.5% vs. 8.3% |

| *Payout data are in millions of dollars, for the fiscal year ended June 30. **Performance data are the annual rate or return in each endowment portfolio manager's area versus the rate of return for the assets used as the benchmark for that investment class. For Meyer, the rate of return is performance for the endowment overall, compared to the benchmark returns on the endowment's "Policy Portfolio" weighted among all asset classes. | ||||

In an interview, HMC president Jack R. Meyer attributed "almost all the difference" in the two money managers' compensation from 2003 to 2004 to performance (see chart). Fiscal-year 2004 results, he said, "were spectacular but somewhat less spectacular than in 2003." In 2004, the domestic bond portfolio achieved a return 12.6 percentage points ahead of its benchmark; in the prior year, the HMC funds returned 13.8 percentage points more than market results. In foreign bonds, the 2004 return was 9.9 percentage points better than the market, compared to a remarkable 34.4 percentage point margin in the prior year.

Beyond the results in the portfolios the managers oversee directly, their compensation is affected by the results of other managers in their investment teams, Meyer said. Those factors, and the change in value of bonuses awarded in prior years (which appreciate or decline in line with the performance of the endowment itself, and are paid out contingent on the managers' own continued superior performance) determine the annual compensation paid. Changes in HMC's formula "at the high end," instituted after the record payments in fiscal year 2003, had only a "very minor" effect on the 2004 awards, he said.

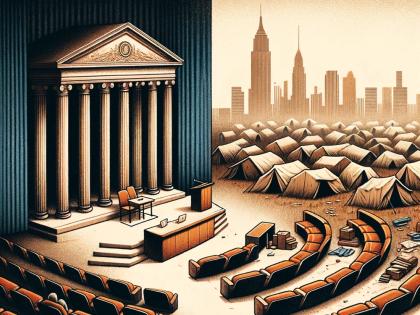

A group of College alumni who had objected to the fiscal year 2003 payments reiterated their critique this year. A statement for the group released by William Strauss '69 dismissed the notion that the bonuses were "fair market" compensation and argued that "the money belonging to a university should not be treated like individual or corporate funds, and that top-quality fund managers can be hired and retained for far less than $25 million apiece."

In an indication of the vast difference in perspective between these critics and some money-management professionals, Boston Globe financial columnist Steve Bailey, AMP '94, published a mock help-wanted ad circulating among hedge-fund managers following the news that Meyer was leaving HMC. The ad, for an "extremely experienced investment professional," specified that applicants "should be interested in taking a 90 percent pay cut from their current, extraordinarily successful private-sector careers in exchange for public disclosure of their compensation."